The budget-busting mixture of emerging loan charges and record-high costs squashed Southern California homebuying in March.

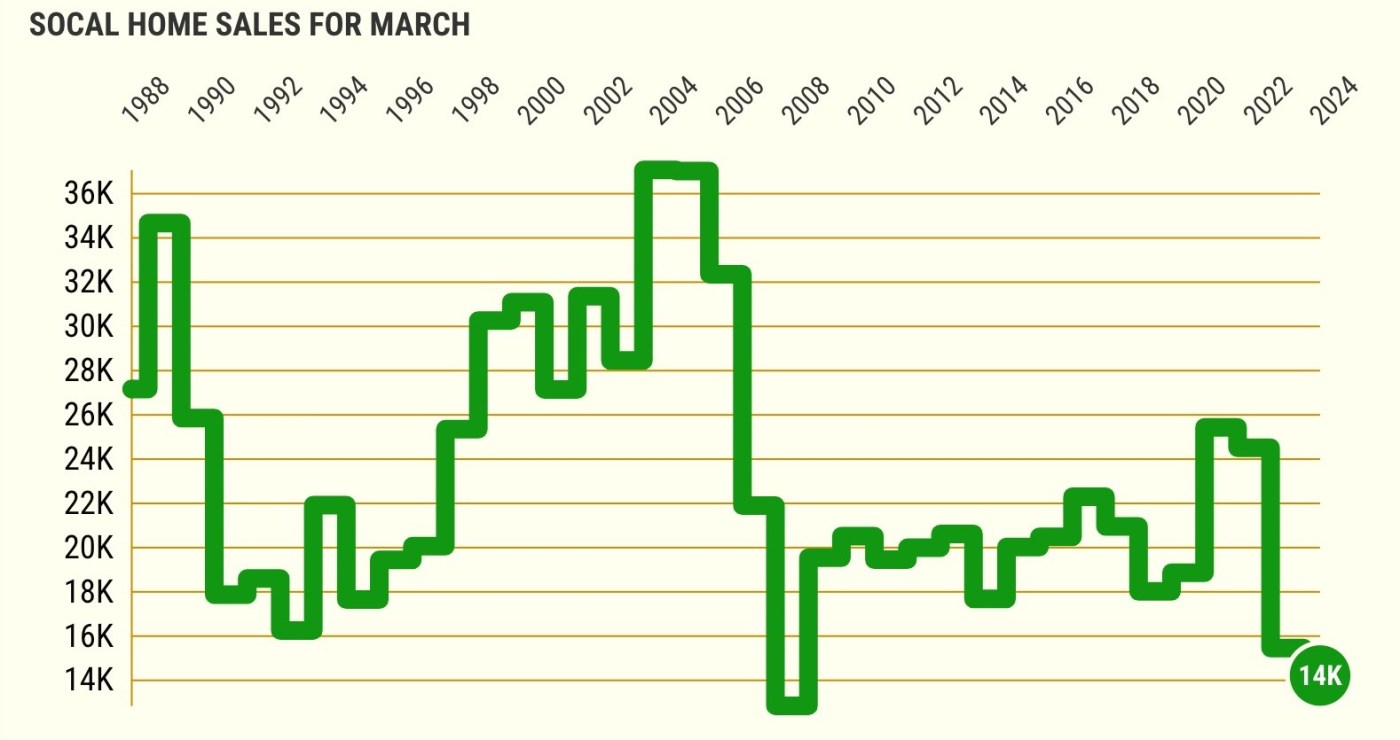

The six-county area had 14,176 finished gross sales in March of current and new homes, townhomes, and condos, in step with knowledge launched via CoreLogic on Monday, April 29. This used to be the second-slowest March in Southern California since 1988. Best March 2008, amid an international monetary cave in, had fewer gross sales. This March’s purchasing tempo additionally ran 39% under moderate.

Torpid homebuying, on the other hand, didn’t forestall the six-county area’s median gross sales value from attaining a brand new height. Costs rose 1.8% in March – and eight% in a yr – to a record-high $753,000, besting the outdated April 2022 list via $3,000.

All-time excessive costs additionally had been set in Orange, Riverside, and San Diego counties.

What used to be nearly as surprising used to be the meek gross sales momentum of March, a month that normally sees an enormous bump in homebuying because the gradual iciness length morphs right into a spring surge. Sure, the area’s March gross sales had been up 14% from February, however that building up used to be the smallest soar in 37 years of Southern California information. It additionally used to be some distance under the common 36% February-to-March gross sales acquire.

The yr had began with business hopes there could be…